Technical Analysis Indicators

What is a technical analysis indicator?

Technical indicators calculate metrics associated to a financial instrument. This calculation can be primarily based on price, volume, on-chain data, open interest, social metrics, or even another indicator.

As we’ve discussed earlier, technical analysts base their strategies on the assumption that historical price patterns may dictate future price movements. As such, traders who use technical analysis may also use an array of technical indicators to select out potential entry and exit points on a chart.

Technical indicators may additionally be categorized by more than one methods. This can encompass whether they’re pointing towards future developments (leading indicators), confirming a sample that’s already underway (lagging indicators), or make clear real-time events (coincident indicators).

Some other categorization may also concern itself with how these indicators present the information. In this sense, there are overlay indications that overlay data over price, and there are oscillators that oscillate between a minimal and a maximum value.

There are additionally types of indicators that aim to measure a particular factor of the market, such as momentum indicators. As the title would suggest, they aim to measure and show market momentum.

So, which is the best technical analysis indicator out there? There isn’t a simple reply to this question. Traders may use many different sorts of technical indicators, and their preference is generally based on their individual trading strategy. However, to be capable to make that choice, they wished to research about them first – and that’s what we’re going to do in this chapter.

Leading vs. lagging indicators

As we’ve discussed, distinct warning signs will have wonderful traits and need to be used for particular purposes. Leading indications factor toward future events. Lagging indications are used to affirm some thing that has already happened. So, when have to you use them?

Leading warning signs are commonly beneficial for short- and mid-term analysis. They are used when analysts anticipate a trend and are searching for statistical tools to back up their hypothesis. Especially when it comes to economics, leading indicators can be mainly useful to predict periods of recession.

When it comes to trading and technical analysis, main indicators can additionally be used for their predictive qualities. However, no unique indicator can predict the future, so these forecasts have to continually be taken with a grain of salt.

Lagging signals are used to affirm activities and developments that had already happened, or are already underway. This can also appear redundant, however it can be very useful. Lagging indicators can carry certain aspects of the market to the spotlight that otherwise would remain hidden. As such, lagging indicators are normally applied to longer-term chart analysis.

What is a momentum indicator?

Momentum indications look out to measure and show market momentum. What is market momentum? In simple terms, it’s the measure of the speed of price changes. Momentum indicators aim to measure the rate at which prices rise or fall. As such, they’re generally used for short-term analysis by traders who are searching to profit from bursts of high volatility.

The purpose of a momentum dealer is to enter trades when momentum is high, and exit when market momentum starts to fade. Typically, if volatility is low, the price tends to squeeze into a small range. As the tension builds up, the charge often makes a big impulse move, eventually breaking out of the range. This is when momentum traders thrive.

After the move has concluded and the traders have exited their position, they move on to any other asset with high momentum and try to repeat the same recreation plan. As such, momentum indicators are broadly used by day traders, scalpers, and short-term traders who are searching for quick trading opportunities.

What is the trading volume?

The trading volume may additionally be considered the quintessential indicator. It suggests the wide variety of person devices traded for an asset in a given time. It essentially suggests how much of that asset modified hands in the course of the measured time.

Some think about the trading volume to be the most important technical indicator out there. “Volume precedes price” is a famous saying in the trading world. It suggests that large trading volume can be a leading indicator before a big price move (regardless of the direction).

By using volume in trading, traders can measure the strength of the underlying trend. If excessive volatility is accompanied by high trading volume, that may additionally be regarded a validation of the move. This makes sense because excessive buying and selling activity should equal a significant volume due to the fact that many traders and investors are active at that precise price level. However, if volatility isn’t accompanied by high volume, the underlying trend might also be considered weak.

Price tiers with traditionally high volume may also give a good potential entry or exit point for traders. Since history tends to repeat itself, these levels may also be where increased trading activity is more possibly to happen. Ideally, support and resistance levels should additionally be accompanied by an uptick in volume, confirming the strength of the level.

What is the Relative Strength Index (RSI)?

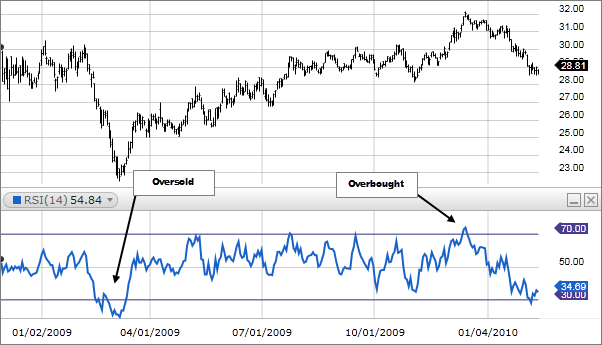

The Relative Strength Index (RSI) is an indicator that illustrates whether or not an asset is overbought or oversold. It is a momentum oscillator that indicates the rate at which price adjustments happen. This oscillator varies between zero and 100, and the data is usually displayed on a line chart.

What’s the concept behind measuring market momentum? Well, if the momentum is increasing whilst the price is going up, the uptrend may additionally be considered strong. Conversely, if momentum is diminishing in an uptrend, the uptrend can also be regarded weak. In this case, a reversal may be coming.

Let’s see how the traditional interpretation of the RSI works. When the RSI value is below 30, the asset may be regarded oversold. In contrast, it might also be viewed overbought when it’s above 70.

Still, RSI readings need to be taken with a degree of skepticism. The RSI can attain intense values throughout extraordinary market conditions – and even then, the market trend may nonetheless continue for a while.

The RSI is one of the best technical indicators to understand, which makes it one of the best for novice traders. If you’d like to know more about it, take a look at out What is the RSI Indicator?.

What is a Moving Average (MA)?

Moving averages smooth out price action and make it less difficult to spot market trends. As they’re primarily based on previous price data, they lack predictive qualities. As such, moving averages are regarded lagging indicators.

Moving averages have different types – the two most common one is the simple moving average (SMA or MA) and the exponential moving average (EMA). What’s the difference between them?

The exponential moving average is a bit trickier. It makes use of a different system that puts a bigger emphasis on more recent price data. As a result, the EMA reacts more rapidly to latest events in price action, whilst the SMA can also take greater time to catch up.

As we’ve mentioned, transferring averages are lagging indicators. The longer the duration they plot, the increased the lag. As such, a 200-day moving average will react slower to unfolding price action than a 100-day moving average.

Moving averages can assist you without problems identify market trends. If you’d like to study more about them, take a look at out Moving Averages Explained.

What is the Moving Average Convergence Divergence (MACD)?

The MACD is an oscillator that makes use of two moving averages to exhibit the momentum of a market. As it tracks price action that has already occurred, it’s a lagging indicator.

The MACD is made up of two lines – the MACD line and the signal line. How do you calculate them? Well, you get the MACD line by subtracting the 26 EMA from the 12 EMA. Simple enough. Then, you plot this over the MACD line’s 9 EMA – the signal line. In addition, many charting tools will additionally show a histogram that illustrates the distance between the MACD line and the signal line.

Traders may also use the MACD by observing the relationship between the MACD line and the signal line. A crossover between the two lines is generally a notable event when it comes to the MACD. If the MACD line crosses above the sign line, that may additionally be interpreted as a bullish signal. In contrast, if the MACD line crosses under the signal, that may additionally be interpreted as a bearish signal.

The MACD is one of the most famous technical indications out there to measure market momentum.

What is the Fibonacci Retracement tool?

The Fibonacci Retracement (or Fib Retracement) tool is a famous indicator primarily based on a string of numbers referred to as the Fibonacci sequence. These numbers were identified in the thirteenth century, through an Italian mathematician known as Leonardo Fibonacci.

The Fibonacci numbers are now part of many technical evaluation indicators, and the Fib Retracement is amongst the most famous ones. It makes use of ratios derived from the Fibonacci numbers as percentages. These percentages are then plotted over a chart, and merchants can use them to perceive practicable assist and resistance levels.

These Fibonacci ratios are:

0%

23.6%

38.2%

61.8%

78.6%

100%

While 50% is technically no longer a Fibonacci ratio, many merchants also reflect consideration on it when using the tool. In addition, Fibonacci ratios outside of the 0-100% vary may additionally be used. Some of the most frequent ones are 161.8%, 261.8%, and 423.6%.

So, how can merchants use the Fibonacci Retracement levels? The important concept behind plotting percentage ratios on a chart is to discover areas of interest. Typically, merchants will choose two significant price factors on a chart, and pin the zero and one hundred values of the Fib Retracement tool to those points. The range outlined between these factors might also highlight potential entry and exit points, and assist determine stop-loss placement.

What is the Stochastic RSI (StochRSI)?

The Stochastic RSI, or StochRSI, is a derivative of the RSI. Similarly to the RSI, it’s essential purpose is to decide whether or not an asset is overbought or oversold. In contrast to the RSI, however, the StochRSI isn’t generated from price data, however RSI values. On most charting tools, the values of the StochRSI will range between zero and 1 (or zero and 100).

The StochRSI tends to be the most beneficial when it’s close to the upper or lower extremes of its range. However, due to its increased velocity and greater sensitivity, it may additionally produce a lot of false indicators that can be difficult to interpret.

The normal interpretation of the StochRSI is somewhat comparable to that of the RSI. When it’s over 0.8, the asset may be considered overbought. When it’s beneath 0.2, the asset can also be viewed oversold. However, it’s well worth citing that these shouldn’t be seen as direct indicators to enter or exit trades. While this data is actually telling a story, there may additionally be different aspects to the story as well. This is why most technical evaluation equipment are quality used in aggregate with different market evaluation techniques.

What are Bollinger Bands (BB)?

Named after John Bollinger, the Bollinger Bands measure market volatility, and are frequently used to spot overbought and oversold conditions. This indicator is made up of three lines, or “bands” – an SMA (the middle band), and an top and decrease band. These bands are then positioned on a chart, alongside with the price action. The thought is that as volatility will increase or decreases, the distance between these bands will change, increasing and contracting..

Let’s go via the general interpretation of Bollinger Bands. The closer the price is to the top band, the closer the asset may be to overbought conditions. Similarly, the closer it is to the lower band, the closer the asset might also be to oversold conditions.

One element to take note of is that the price will generally be contained inside the range of the bands, however it may break above or below them at times. Does this imply that it’s an instant signal to buy or sell? No. It just tells us that the market is moving away from the middle band SMA, reaching intense conditions.

Traders may additionally use Bollinger Bands to try and predict a market squeeze, also regarded as the Bollinger Bands Squeeze. This refers to a duration of low volatility when the bands come really close to each other and “squeeze” the price into a small range. As the “pressure” builds up in that small range, the market finally pops out of it, leading to a time of multiplied volatility. Since the market can move up or down, the squeeze strategy is viewed neutral (neither bearish or bullish). So it would possibly be really worth combining it with different trading tools, such as support and resistance.

What is the Volume-Weighted Average Price (VWAP)?

As we’ve mentioned earlier, many merchants consider the trading volume to be the most essential indicator out there. So, are there any indicators based on volume?

The volume-weighted average price, or VWAP, combines the energy of volume with price action. In more realistic terms, it’s the average cost of an asset for a given period weighted by volume. This makes it more beneficial than just calculating the average price, as it also takes into account which fee levels had the most trading volume.

How do traders use the VWAP? Well, the VWAP is normally used as a benchmark for the contemporary outlook on the market. In this sense, when the market is above the VWAP line, it might also be viewed bullish. At the identical time, if the market is beneath the VWAP line, it can also be regarded bearish. Have you observed how this is comparable to the interpretation of shifting averages? The VWAP may certainly be compared to moving averages, at least in the way it’s used. As we’ve seen, the main distinction is that the VWAP considers the trading extent as well.

In addition, the VWAP can additionally be used to pick out areas of greater liquidity. Many traders will use the charge breaking above or under the VWAP line as a trade signal. However, they will normally additionally include different metrics into their method to minimize risks.

Would you like to examine greater about how you can use the VWAP? Check out Volume-Weighted Average Price (VWAP) Explained.

What is the Parabolic SAR?

The Parabolic SAR is used to decide the path of the trend and plausible reversals. “SAR” stands for Stop and Reverse. This refers to the factor where a long function ought to be closed and a quick position opened, or vice versa.

The Parabolic SAR appears as a collection of dots on a chart, both above or under the price. Generally, if the dots are beneath the price, it capacity the rate is in an uptrend. In contrast, if the dots are above the price, it capacity the charge is in a downtrend. A reversal happens when the dots flip to the “other side” of the price.

The Parabolic SAR can grant insights into the course of the market trend. It’s additionally handy for figuring out factors of trend reversal. Some traders may additionally use the Parabolic SAR indicator as a basis for their trailing stop-loss. This unique order type moves alongside with the market and makes sure that traders can protect their income all through a sturdy uptrend.

The Parabolic SAR is at its best during strong market trends. During periods of consolidation, it might also provide a lot of false alerts for possible reversals.

What is the Ichimoku Cloud?

The Ichimoku Cloud is a TA indicator that combines many indications in a single chart. Among the indicators we’ve discussed, the Ichimoku is absolutely one of the most complicated. At first glance, it may also be hard to understand its formulas and working mechanisms. But in practice, the Ichimoku Cloud is not as hard to use as it seems, and many traders use it due to the fact it can produce very distinct, well-defined buying and selling signals.

As mentioned, the Ichimoku Cloud isn’t simply an indicator, it’s a series of indicators. It’s a series that presents insights into market momentum, help and resistance levels, and the direction of the trend. It achieves this by calculating 5 averages and plotting them on a chart. It additionally produces a “cloud” from these averages which may forecast potential support and resistance areas.

While the averages play an essential role, the cloud itself is a key part of the indicator. Generally, if the price is above the cloud, the market might also be considered to be in an uptrend. Conversely, if the rate is beneath the cloud, it may also be viewed to be in a downtrend.

The Ichimoku Cloud may additionally give a boost to different trading signals.

The Ichimoku Cloud is difficult to master, however as soon as you get your head around how it works, it can produce excellent results.