One of the downsides of any bullish crypto price run is a fundamental uptick in the prevalence of crypto pump and dump schemes. This phenomenon has been evident again in 2021.This article identifies how to know a pump and dump when you see one and which coins are the most likely to be targeted.

While bitcoin has become an accepted alternative asset class with regulated exchanges, institutional investor interest, and its very own futures contracts, many altcoins are still operating in a ‘wild west’ type environment – with even ‘reputable’ projects still being victimized as the 51% attacks on Ethereum Classic has shown. 2021 has been a busy year for crypto scams and traders need to be aware that many cryptocurrencies stay vulnerable to being hijacked by so-called crypto pump and dump schemes.

John McAfee was going to be charged as a pump and dumper

In May, federal prosecutors introduced their intention to charge recently deceased tech entrepreneur John McAfee, after linking him to numerous pump-and-dump initiatives involving crypto assets.

Authorities alleged that between 2017 and 2018, McAfee promoted a “coin of the day” by using his Twitter account without disclosing to his followers that he and his associates had already purchased positions in the coin that they would sell as soon as the price pumped.

The scheme involved several digital assets, which includes Verge (XVG), Dogecoin (DOGE), and ReddCoin (RDD). This enforcement action is the first brought by the CFTC for a manipulative scheme involving digital assets. “Manipulative and fraudulent schemes, like that alleged in this case, undermine the integrity and development of digital assets and cheat innocent individuals out of their hard-earned money,” said Acting Director of Enforcement Vincent McGonagle. “Financial innovation is continuously breaking new ground, and the CFTC’s enforcement efforts have to hold up. We will constantly act to keep fraudsters and manipulators accountable for misconduct.”

Did Elon Musk pump and dump Bitcoin?

With Bitcoin falling more than 50% from its high of $64,000 earlier this year, this month Tesla CEO Elon Musk was forced to deny claims that he had pumped and dumped Bitcoin.

The denial was brought about after an accusation by Magda Wierzycka, the CEO of financial services firm Sygnia. Wierzycka said, “the volatility we have seen is an unexpected function of what I would call market manipulation by Elon Musk, and if that happened to a listed business enterprise he would be investigated and severely sanctioned by the SEC.” Wierzycka, who made the comments in a podcast, accused Musk of buying a position in BTC, then announcing its position to pump the price, before selling at the peak.

In response, Musk stated that “Tesla only sold ~10% of holdings to confirm BTC could be liquidated effortlessly without moving the market,” a reference to Tesla’s first-quarter bitcoin sale that resulted in proceeds of $272 million after a number of tweets touting the cryptocurrency.

It is worth remembering that Musk paid US$40 million in 2018 to settle SEC charges against him for his tweets about taking Tesla private. According to the SEC’s complaint, Musk’s deceptive tweets prompted Tesla’s stock fee to jump by over six percentage on August 7, 2018 and led to significant market disruption.

The SEC also charged Tesla with failing to have required disclosure controls and strategies relating to Musk’s tweets, a charge that the company agreed to settle.

What is a crypto pump and dump scheme?

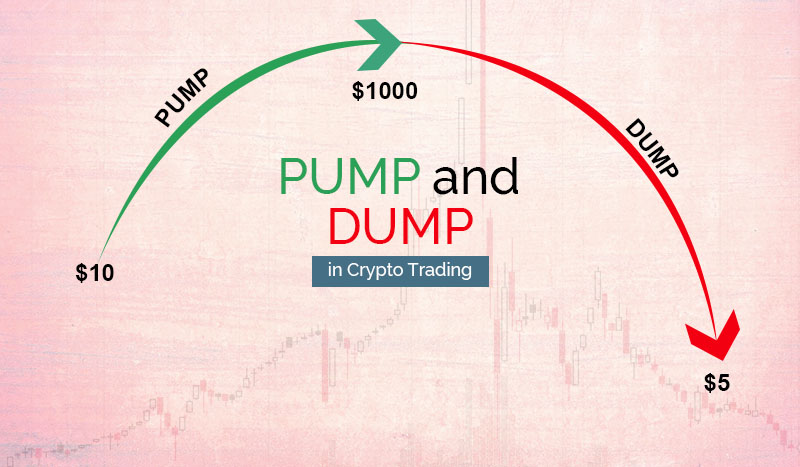

Pump and dump schemes are nothing new – they are a form of securities fraud that have existed for a long time and originally focused on the equity markets. More specifically, on small-cap stocks. The way an equity markets pump and dump scheme works is that a small group of investors select and purchase shares in a enterprise with a low market capitalization, thereby inflicting an initial jump in price.

Next, call center operations – more commonly known as boiler rooms – call potential private traders with the intention of convincing them to buy the stock by using providing false information claiming the stock is about to experience huge gains. Once enough investors have been misled into buying the stock and its price has risen by enough, the initial group of traders will sell their holdings to take profit, before the price collapses and all following investors make heavy losses.

Ledger Nano X –What is a crypto pump and dump scheme

This kind of securities fraud has additionally made it into the cryptocurrency markets. While the modus operandi has changed, pump and dump schemes are alive and kicking in the altcoin market due to its unregulated nature.

These schemes target low capitalization cryptocurrencies and digital tokens that can easily be manipulated with low trading volumes. Instead of boiler rooms, the price pumps are carried out via spreading hype and fake records about a coin on social media.

The feedback section of crypto-related videos on YouTube is a top target for coin hype. For example, the Brave New Coin YouTube channel’s comments section is moderated on a day by day basis for possible pump and dump scams. In this scenario, people try to hijack discussions and inject comments about a coin they are making an attempt to hype into otherwise true conversations.

As the examples under show, the format is easily recognizable – usually beginning with a thank you and then an inquiry about a certain coin or project. Posted on many different channels, these types of comments give the impression there is genuine enthusiasm about a project, whereas in reality there is no such groundswell of interest.

Communication amongst pump and dump team members happens on encrypted messaging offerings such as Telegram, where organizations can contain several thousand contributors and are generally entered upon invitation.

In these team chats, a coin that will be “pumped” will be introduced after the original perpetrator of the scam buys the coin. Within minutes, team contributors also purchase and then spread fake information about the coin on social media, blogs and sometimes even on news outlets thought of as reputable through paid-for sponsored content.

Once the price has jumped, the initiators of the pump sell their coins, followed by different members in the pump and dump messaging group. Then the price collapses again, leaving all investors who bought after the price surge with steep losses.

Another phenomenon that is keeping apart vulnerable investors from their money in 2021 is crypto projects that don’t even hassle with the pretense of creating a product or a use case.

Close examination of their websites and white papers reveals no underlying business model or technology use case at all. Or if there is one, it makes no commercial sense.

The financial model of these tasks is that funds are spent on minting trillions (or quadrillions) of tokens, observed by maximum-hype marketing, well-designed websites and huge social media pushes. The end game for these tokens is a major exchange listing, where, in a best-case scenario, speculative momentum keeps the game going. Brave New Coin does not promote these kinds of projects, but most crypto media continues to do so.

How to spot a crypto pump and dump scheme

The best way to identify a pump and dump scheme is when an unknown coin abruptly rises substantially without a actual reason to do so. This can be effortlessly considered on a coin’s price chart. Coincheckup, for example, has set a benchmark of a 5% price increase in less than 5 minutes as its indicator.

Also, when you see paid information articles about a small cap coin performing in aggregate with a surge in social media recreation surrounding that unique cryptocurrency project, this should be the signal of a pump taking place. If an totally unknown coin with market capitalization of only a few million bucks unexpectedly seems all over Twitter and Facebook, one ought to be wary.

How to protect yourself from pump and dumps

Pump and dumps are generally confined to coins with very low trading volumes and market capitalizations. By avoiding illiquid cryptocurrencies, your chances of falling victim to a pump and dump are extensively reduced. Furthermore, not following investment advice on social media or from paid news articles will additionally prevent you from making preventable losses due to this kind of market manipulation. There was once a time when you may want to be confident that media organizations would have carried out some vetting.

A good rule of thunb is to remember that anyone promising that they recognize which crypto coin will pump next, likely has an ulterior motive.

A surprising leap in price without actual verified information backing the increase is an indicator of a potential pump and dump scheme unfolding. Hence, if the price chart says a pump is underway, it is best to keep away from the coin altogether except you have achieved your research on the digital currency and its potential future value.

The BitcoinTalk forum is a right place to do some research, and Reddit can be a good source as well. In general terms the wider cryptocurrency community likes to self-regulate and call out fraudulent players who damage the community’s reputation. Contacting cryptocurrency projects directly and getting your questions answered is an even better way to research a coin before investing in it. Finally, independent research can additionally be used to make better investment decisions.

The CFTC will pay pump and dump whistleblowers

To combat the unfortunate phenomenon of pump and dump schemes in the cryptocurrency markets, the U.S. Commodity Futures Trading Commission has introduced that it is offering financial incentives for whistleblowers who are involved in such pump and dump groups.

The CFTC published a consumer advisory statement warning investors of cryptocurrency pump and dump schemes. In the announcement, the CFTC advises “customers to keep away from pump-and-dump schemes that can occur in thinly traded or new ‘alternative’ digital currencies and digital coins or tokens. Customers should not buy virtual currencies, digital coins, or tokens based on social media tips or sudden fee spikes.”

In addition to its warning, the CFTC additionally informed consumers that they “could be eligible for a monetary award of between 10 percent and 30 percent” if participants of pump and dump businesses are capable to grant original information that “leads to financial sanctions of $1 million or more.” In other words, the CFTC wishes to pay whistleblowers a reward if they can make contributions valuable information that leads to discovering the perpetrators behind such schemes.

The practice of paying whistleblowers is not new and already commonplace in the usual financial markets (the SEC pays out hundreds of millions a year, for example). However, it was only in 2019 that U.S. regulators have additionally began to eye the cryptocurrency markets in this regard.