Technical Analysis Basics

What is a long position?

A long position (or simply long) means buying an asset with the expectation that its value will rise. Long positions are regularly used in the context of derivatives products or Forex, however they apply to basically any asset class or market type. Buying an asset on the spot market in the hopes that its rate will increase also constitutes a long position.

Going long on a financial product is the most popular way of investing, specially for those just starting out. Long-term trading techniques like buy and hold are primarily based on the assumption that the underlying asset will increase in value. In this sense, buy and hold is simply going long for an elongated duration of time.

However, being long doesn’t always imply that the trader expects to gain from an upward movement in price. Take leveraged tokens, for example. BTCDOWN is inversely correlated to the price of Bitcoin. If the price of Bitcoin goes up, the price of BTCDOWN goes down. If the price of Bitcoin goes down, the price of BTCDOWN goes up. In this sense, getting into a long position in BTCDOWN equals a downward motion in the price of Bitcoin.

What is shorting?

A short position (or short) simply is selling an asset with the intention of rebuying it later at a lower price. Shorting is closely related to margin trading, as it may happen with borrowed assets. However, it’s additionally widely used in the derivatives market, and can be executed with a simple spot position. So, how does shorting work?

When it comes to shorting on the spot markets, it’s pretty simple. Let’s say you already have Bitcoin and you anticipate the price to go down. You sell your BTC for USD, as you plan to rebuy it later at a lower price. In this case, you’re actually entering a short position on Bitcoin since you’re selling high to rebuy lower. Easy enough. But what about shorting with borrowed funds? Let’s see how that works.

You borrow an asset that you assume will reduce in price – for example, a inventory or a cryptocurrency. You immediately sell it. If the trade goes your way and the asset price decreases, you buy it back the same amount of the asset that you’ve borrowed. You repay the belongings that you’ve borrowed (along with interest) and profit from the difference between the price you originally sold and the price you rebought.

So, what does shorting Bitcoin look like with borrowed funds? Let’s look at an example. We put up the required collateral to borrow 1 BTC, then without delay promote it for $10,000. Now we’ve got $10,000. Let’s say the price goes down to $8,000. We purchase 1 BTC and repay our debt of 1 BTC alongside with interest. Since we at the beginning sold Bitcoin for $10,000 and now rebought at $8,000, our income is $2,000 (minus the interest fee and trading fees).

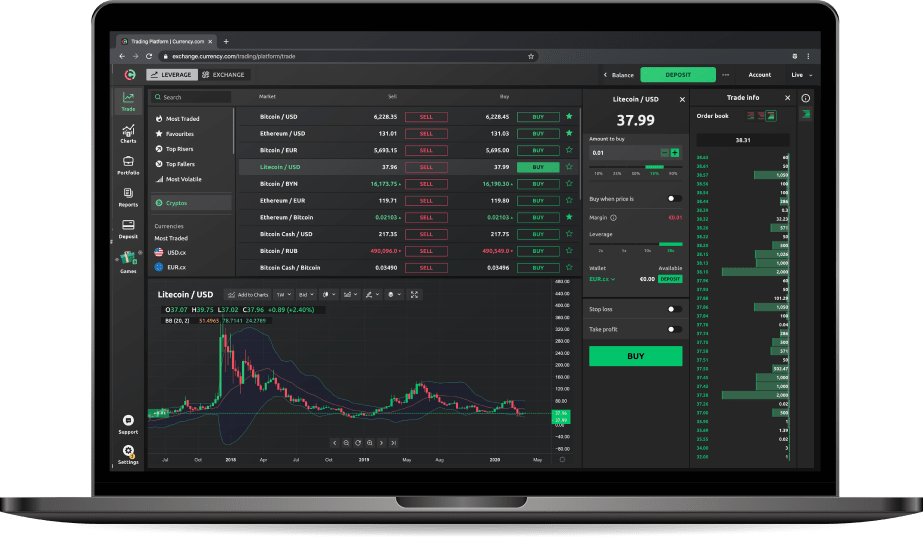

What is the order book?

The order book is a collection of the presently open orders for an asset, organized by price. When you publish an order that isn’t filled immediately, it gets added to the order book. It will sit there till it gets filled by another order or canceled.

Order books will vary with every platform, but generally, they’ll contain roughly the same information. You’ll see the number of orders at precise price levels.

When it comes to crypto exchanges and online trading, orders in the order book are matched by a system known as the matching engine. This system is what ensures that trades are accomplished – you could think of it as the brain of the exchange. This system, alongside with the order book, is core to the concept of electronic exchange.

What is the order book depth?

The order book depth (or market depth) refers to a visualization of the presently open orders in the order book. It commonly puts buy orders on one side, and sell orders on the other and displays them cumulatively on a chart.

In more conventional terms, the depth of the order book may additionally refer to the amount of liquidity that the order e book can absorb. The “deeper” the market is, the greater liquidity there is in the order book. In this sense, a market with more liquidity can absorb larger orders without a tremendous impact on the price. However, if the market is illiquid, large orders may additionally have a considerable impact on the price.

What is a market order?

A market order is an order to buy or sell at the quality presently accessible market price. It’s essentially the quickest way to get in or out of a market.

When you’re putting a market order, you’re essentially saying: “I’d like to execute this order right now at the best price I can get.”

Your market order will keep filling orders from the order book till the complete order is utterly filled. This is why large traders (or whales) can have a substantial impact on the price when they use market orders. A large market order can efficaciously siphon liquidity from the order book. How so? Let’s go thru it when discussing slippage.

What is slippage in trading?

There is something you need to be conscious of when it comes to market orders – slippage. When we say that market orders fill at the best available price, that simply means that they maintain filling orders from the order book till the entire order is executed.

However, what if there isn’t sufficient liquidity around the preferred rate to fill a large market order? There should be a huge difference between the price that you expect your order to fill and the price that it fills at. This difference is known as slippage.

Let’s say you’d like to open a long position worth 10 BTC in an altcoin. However, this altcoin has a pretty small market cap and is being traded on a low-liquidity market. If you use a market order, it will hold filling orders from the order book till the whole 10 BTC order is filled. On a liquid market, you would be able to fill your 10 BTC order without impacting the rate significantly. But, in this case, the lack of liquidity means that there might also not be adequate sell orders in the order book for the current price range.

So, by the time the whole 10 BTC order is filled, you may also find out that the average price paid was much higher than expected. In other words, the lack of sell orders prompted your market order to move up the order book, matching orders that had been drastically greater expensive than the initial price.

Be conscious of slippage when trading altcoins, as some buying and selling pairs may not have enough liquidity to fill your market orders.

What is a limit order?

A limit order is an order to buy or sell an asset at a unique price or better. This price is called the limit price. Limit buy orders will execute at the limit price or lower, whilst limit sell orders will execute at the limit rate or higher.

When you’re placing a restriction order, you’re essentially saying: “I’d like to execute this order at this precise price or better, but never worse.”

Using a restriction order permits you to have more control over your entry or exit for a given market. In fact, it ensures that your order will in no way fill at a worse price than your preferred price. However, that additionally comes with a downside. The market may in no way reach your price, leaving your order unfilled. In many cases, this can imply losing out on a potential trade opportunity.

Deciding when to use a limit order or market order can vary with every trader. Some merchants may use only one or the other, whilst different traders will use both – depending on the circumstances. The essential factor is to recognize how they work so you can figure out for yourself.

What is a stop-loss order?

Now that we understand what market and limit orders are, let’s discuss about stop-loss orders. A stop-loss order is a kind of restrict or market order that’s only activated when a certain price is reached. This price is known as the stop price.

The motive of a stop-loss order is generally to restrict losses. Every exchange needs to have an invalidation point, which is a price level that you need to define in advance. This is the level where you say that your preliminary thought was wrong, that means that you must exit the market to forestall further losses. So, the invalidation factor is where you would typically put your stop-loss order.

How does a stop-loss order work? As we’ve mentioned, the stop-loss can be both a limit or a market order. This is why these variants may equally be referred to as stop-limit and stop-market orders. The key factor to understand is that the stop-loss only activates when a sure price is reached (the stop price). When the stop price is reached, it activates either a market or a limit order. You essentially set the stop price as the trigger for your market or limit order.

However, there is one factor you need to keep in mind. We comprehend that restriction orders only fill at the limit price or better, however never worse. If you’re making use of a stop-limit order as your stop-loss and the market crashes violently, it may additionally instantly move away from your limit price, leaving your order unfilled. In other words, the stop price would set off your stop-limit order, however the limit order would stay unfilled due to the sharp price drop. This is why stop-market orders are viewed safer than stop-limit orders. They make sure that even under intense market conditions, you’ll be assured to exit the market as soon as your invalidation point is reached.

What are makers and takers?

You turn out to be a maker when you place an order that doesn’t right away get filled but gets introduced to the order book. Since your order is including liquidity to the order book, you’re a “maker” of liquidity.

Limit orders will typically execute as maker orders, however not in all cases. For example, let’s say you place a limit buy order with a limit price that’s drastically higher than the present day market price. Since you’re saying your order can execute at the limit price or better, your order will execute in opposition to the market rate (as it’s reduces than your limit price).

You become a taker when you place an order that gets immediately filled. Your order doesn’t get delivered to the order book, however is immediately matched with an existing order in the order book. Since you’re taking liquidity from the order book, you’re a taker. Market orders will constantly be taker orders, as you’re executing your order at the best currently accessible market price.

Some exchanges adopt a multi-tier fee model to incentivize merchants to provide liquidity. After all, it’s in their interest to appeal to high volume traders to their exchange – liquidity attracts more liquidity. In such systems, makers tend to pay lower prices than takers, given that they’re the ones adding liquidity to the exchange. In some cases, they can also even provide fee rebates to makers. You can take a look at your contemporary fee tier on Binance on this page.

What is the bid-ask spread?

The bid-ask spread is the distinction between the perfect buy order (bid) and the lowest sell order (ask) for a given market. It’s really the gap between the highest price where a seller is inclined to sell and the lowest price where a purchaser is inclined to buy.

The bid-ask spread is a way to measure a market’s liquidity. The smaller the bid-ask spread is, the more liquid the market is. The bid-ask spread can also be regarded as a measure of supply and demand for a given asset. In this sense, the supply is represented via the ask side whilst the demand by the bid side.

When you’re putting a market buy order, it will fill at the lowest accessible ask price. Conversely, when you place a market sell order, it will fill at the best possible available bid.

What is a candlestick chart?

A candlestick chart is a graphical representation of the price of an asset for a given timeframe. It’s made up of candlesticks, each representing the same amount of time. For example, a 1-hour chart indicates candlesticks that each represent a length of one hour. A 1-day chart shows candlesticks that each represent a period of one day, and so on.

A candlestick is made up of 4 data points: the Open, High, Low, and Close (also referred to as the OHLC values). The Open and Close are the first and last recorded rate for the given timeframe, whilst the Low and High are the lowest and highest recorded price, respectively.

Candlestick charts are one of the most essential tools for examining financial data. Candlesticks date back to the seventeenth century Japan however have been refined in the early 20th century by trading pioneers such as Charles Dow.

Candlestick chart analysis is one of the most frequent ways to look at the Bitcoin market using technical analysis.

What is a candlestick chart pattern?

Technical evaluation is largely based totally on the assumption that previous price movements may additionally point out future price action. So, how can candlesticks be beneficial in this context? The idea is to discover candlestick chart patterns and create trade ideas based on them.

Candlestick charts assist traders analyze market structure and decide whether we’re in a bullish or bearish market environment. They may additionally be used to identify areas of interest on a chart, like aid or resistance levels or viable factors of reversal. These are the points on the chart that normally have increased trading activity.

Candlestick patterns are additionally a great way to control risk, as they can present trade setups that are defined and exact. How so? Well, candlestick patterns can list out clear price aims and invalidation points. This permits traders to come up with very precise and controlled trade setups. As such, candlestick patterns are extensively used by Forex and cryptocurrency traders alike.

What is a trend line?

Trend lines are a extensively used tool by both traders and technical analysts. They are lines that join certain data points on a chart. Typically, this data is the price, however not in all cases. Some traders can additionally draw trend lines on technical indications and oscillators.

The principal notion behind drawing trend lines is to visualize certain factors of the price action. This way, traders can become aware of the overall trend and market structure.

The rate of Bitcoin touching a style line a couple of times, indicating an uptrend.

Some traders may also only use trend lines to get a better understanding of the market structure. Others can also use them to create actionable trade ideas primarily based on how the trend lines interact with the price.

Trend lines can be applied to a chart displaying virtually any time frame. However, as with any other market evaluation tool, trend lines on higher time frames have a tendency to be more dependable than trend lines on lower time frames.

Another element to think about right here is the strength of a trend line. The traditional definition of a trend line defines that it has to meet the price at least two or three times to end up valid. Typically, the more times the price has touched (tested) a trend line, the more dependable it will be considered.

If you’d like to read more about how to draw trend lines, check out Trend Lines Explained.

What are support and resistance?

Support and resistance are some of the most fundamental ideas related to trading and technical analysis.

Support means a level where the price finds a “floor.” In other words, a support level is an area of significant demand, where buyers step in and push the rate up.

Resistance means a level where the rate finds a “ceiling.” A resistance level is an area of substantial supply, where sellers step in and push the price down.

Now you are aware that support and resistance are levels of increased demand and supply, respectively. However, many other factors can be at play when thinking about support and resistance.

Technical indicators, such as trend lines, moving averages, Bollinger Bands, Ichimoku Clouds, and Fibonacci Retracement can additionally suggest possible support and resistance levels. In fact, even factors of human psychology are used. This is why traders and investors may incorporate support and resistance very differently in their individual trading strategy.